Charitable Gift Annuities

Gifts That Pay You Income

Calculate Your Benefits

Input a few details and see how a charitable gift annuity can benefit you.

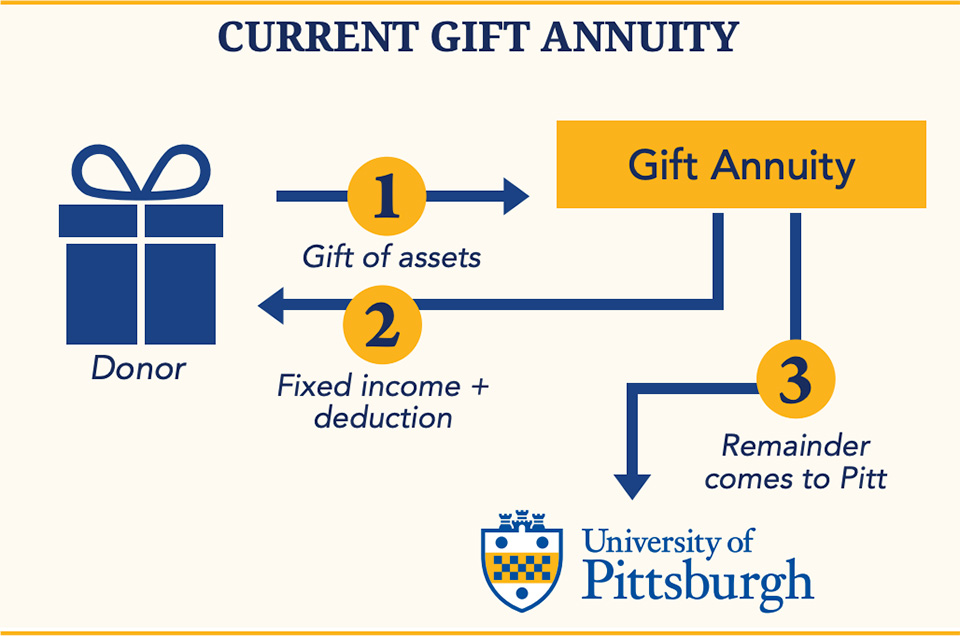

A charitable gift annuity (CGA) benefits you by creating a reliable, lifelong revenue stream for you and/or a loved one, and it benefits the University of Pittsburgh by leaving a gift to carry out the mission of the University after the last beneficiary is gone.

To create a CGA, you simply transfer cash or securities to the University of Pittsburgh. In exchange, Pitt will make secure fixed payments to you and/or another income beneficiary for life. Starting this year, IRA holders 70½ or older may make qualified charitable distributions in one calendar year from an IRA, totaling no more than $50,000, to fund a current CGA without being taxed on the distribution. Additionally, the transfer counts toward a required minimum distribution (RMD) if the donor(s) is older than 73. At the time of the last recipient’s death, the remaining funds in your CGA would be distributed to a specific fund of your choosing at the University.

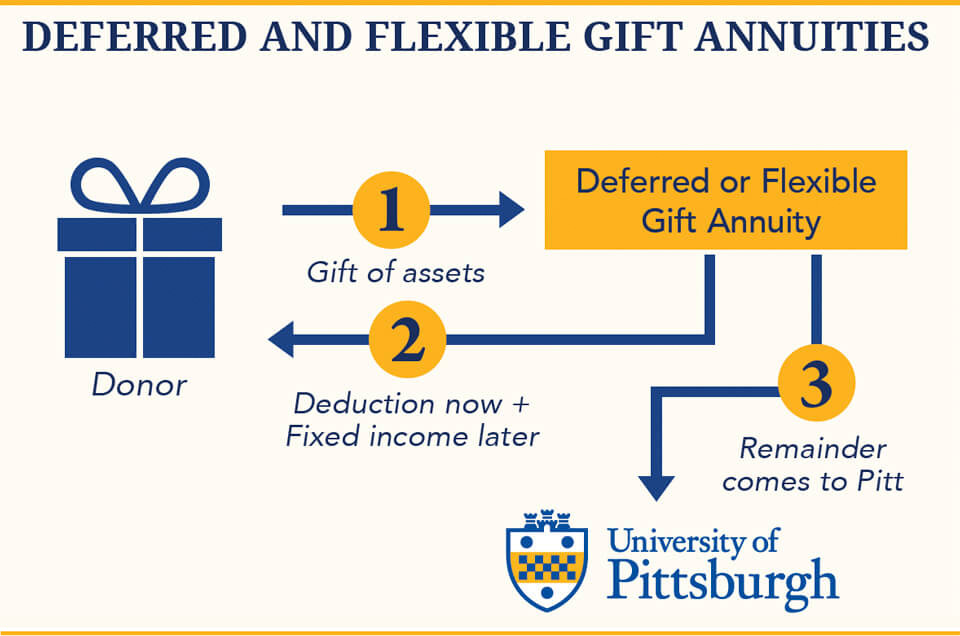

There are two primary types of charitable gift annuities: current and deferred. Each type could qualify for a variety of tax benefits, including a federal income tax charitable deduction if you itemize. Each of these types of CGAs require a gift of at least $10,000.

A current charitable gift annuity begins paying the income beneficiary immediately and continues to do so for the life of the recipient. To create a current CGA, the beneficiary(s) must be at least 55 years old.

With a deferred charitable gift annuity, the donor sets a date in the future when the annuity will begin making payments. The income beneficiary must be at least 40 years old to create a deferred CGA and at least 55 years old to begin receiving payments.

The payout percentage for any CGA is based on age, so the older your income beneficiary(s), the greater the annual payments. Charitable gift annuity rates of return are set by the American Council on Gift Annuities and part of each payment is tax-free.

Contact us today to receive a personalized and confidential illustration to show how a gift annuity would benefit your specific situation. Or use our online calculator to estimate your annual payments.

See How It Works

Payments for Life

Learn more about the many benefits of a charitable gift annuity in our complimentary guide Charitable Gift Annuities: Gifts That Give Back.

View My GuideGifts That Pay

Your payments depend on your age at the time of the donation. If you are younger than 60, we recommend that you learn more about your options and download this complimentary guide Deferred Gift Annuities: Plan Now, Benefit Later.

View My GuideAn Example of How It Works

Dennis, 75, and Mary, 73, want to make a contribution to the University of Pittsburgh but they also want to ensure that they have dependable income during their retirement years. They fund a $25,000 charitable gift annuity with appreciated stock that they originally purchased for $10,000.

Dennis, 75, and Mary, 73, want to make a contribution to the University of Pittsburgh but they also want to ensure that they have dependable income during their retirement years. They fund a $25,000 charitable gift annuity with appreciated stock that they originally purchased for $10,000.

Based on their ages, they will receive a payment rate of 6.0%, which means that they will receive $1,500 each year for the remainder of their lives. They are also eligible for a federal income tax charitable deduction of $8,792* when they itemize. Finally, they know that after their lifetimes, the remaining amount will be used to support our mission.

*Based on a 5.2% charitable midterm federal rate. Deductions and calculations will vary depending on your personal circumstances.